Interactive teller machines combine ATM functionality with the interactivity and service of a live teller. These machines allow our clients to service their customers more effectively, improve customer experience, and save on costs, resulting in a greater return of value than traditional ATMs. Keep reading this ITM FAQ to learn more about what ITMs do, their origins, and how they can save your business money while helping your customers.

What Does an ITM Do?

ITMs have the same functions ATMs do, with added benefits that are useful for most customers. They are the next level of technology and service for financial institutions looking to find more efficient and convenient ways to assist their customers. The latest terminals provide all the services customers expect from in-person tellers in relatively small form factors. ITMs work well in even the tiniest areas, so they are excellent for department stores, lobbies, and other compact locations. Here are some of the most frequently used ITM functions:

- Cash Withdrawals

- Check Cashing and Deposits

- Bill Payments

- Card Replacements

- Funds Transfers

- Money Orders and Bank Checks

- New Account Openings

- Bank and Investment Transactions

Here is How ITMs Differ from ATMs

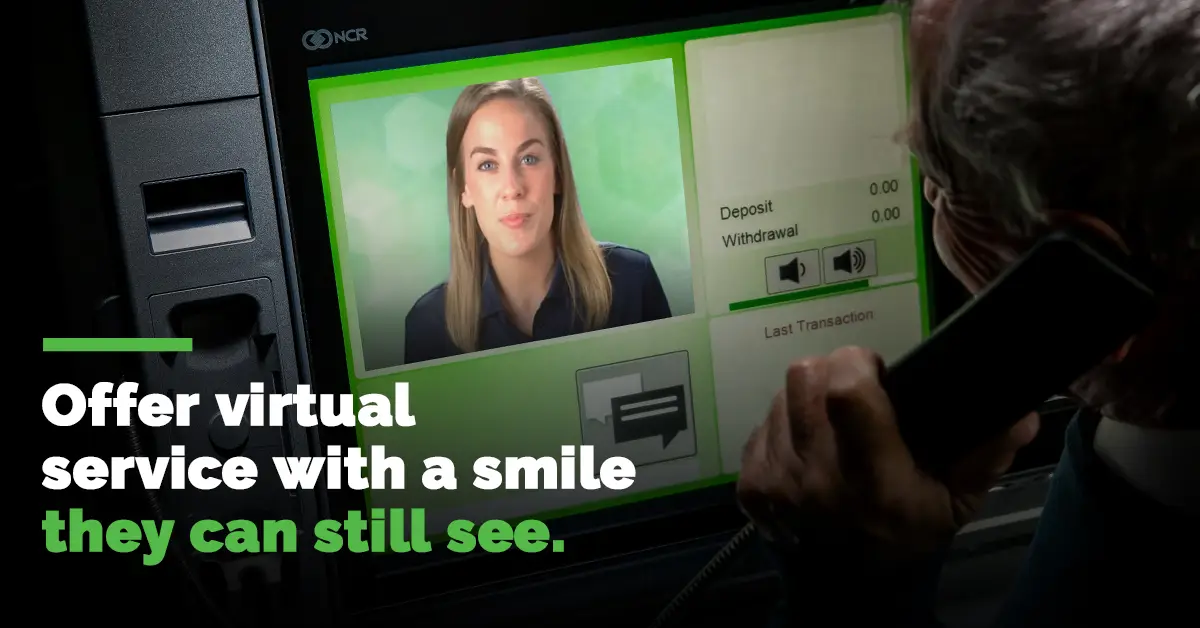

How is an ITM different from an ATM? What advantages does an ITM offer customers that is not available from an ATM? The answers to these questions are an ITMs ability to connect a customer to a live teller. ITM technology allows a teller to assist the customer remotely via video chat. Sometimes the best way to meet a customer’s needs is to provide service from a real person, and that functionality is unavailable at a basic ATM. ITMs offer customer experiences that promote the financial institution’s brand, improve customer approval scores, and help the institution make more money per customer and interaction. ATMs are simple machines, functional but impersonal.

How Does an ITM Benefit the Customer?

The most significant difference between an ITM and an ATM is the value of human interaction. A live remote teller can offer more banking services than a traditional ATM and tailor each experience to the customer, allowing more opportunities for your financial institution. Having a guide ready to assist and answer questions at the press of a button makes customers feel more comfortable and encourages them to do more business. Customers also like that a live teller can assist them with I.D. verification when necessary. Access to funds in smaller denominations not available at ATMs is a bonus.

What are the Benefits of an ITM for the Financial Institution?

ITMs bring financial institutions several notable advantages, including:

- Reduced Costs Over ATMs

- Reduced Costs Over Branches

- Business Expansion

- Improved Service Quality

- More Sales Opportunities

ITMs Improve Savings and Cost Avoidance

Using an ITM could generate massive savings, especially if your organization can transform the way it operates in the future.

Imagine how ITM technology can positively impact your labor expense. ITMs reduce the number of required tellers, allowing financial institutions to reorganize and use personnel more efficiently. Our ITMs have taken some financial institutions from 20% teller utilization to 80%. ITMs also lead to savings in terms of reduced investment in teller work environments. ITMs make work-from-home tellers possible.

There is also the potential for savings as ITMs allow institutions to rebuild or remodel branches that are much smaller than before the ITM. Running a smaller location means lower property, utilities, and building upkeep costs. Closing an ITM is also significantly less expensive and involved than closing or moving a branch.

Another set of costs that ITMs nullify is the costs of ATMs themselves. ITMs cover ATM functions perfectly while increasing features and functionality.

ITMs Help Financial Institutions Expand

The convenient form factor and the complete functionality of an ITM means establishing a new branch is easier than ever. A financial institution can place itself in a new area with minimal effort, which means fewer costs to cover more territory.

Financial institutions can take advantage of the remote service aspect of an ITM to offer longer service hours. ITM tellers do not have to be local, but simply online and available, so institutions can staff employees earlier or later as most beneficial to business.

More ‘branches’ and extended hours mean financial institutions have more opportunities and more time to create long-term customers. ITM technology allows institutions to touch more people, complete more transactions, boost revenues, and see a return on investment that standard ATMs will not replicate.

ITMs Improve Quality Scores

NPS scores give insight into what customers think about a financial institution’s service. Evidence strongly suggests that customers report greater satisfaction with ITM interactions than transactions with traditional tellers and ATMs. Customer satisfaction is the ultimate factor in customer retention, and NPS scores tend to tell the truth. ITM transactions are faster, they save the customer’s time, and computers do not make counting errors. ITMs drive excellent customer experiences that keep people banking with the institutions they trust.

Interactions with ITM Tellers Lead to Increased Sales

Many of the best sales opportunities happen when tellers and bankers have a customer right in front of them. The interpersonal connection allows customers to be more receptive to new ideas and pitches about the financial institution’s products. It is one thing to show a graphic on an ATM screen with a few words about a beneficial product, but there is nothing like having a conversation with the customer in person. Well, there is almost nothing like that. ITMs offer a live conversation with the customer that is as effective as in-person interaction. The customers and agents can see each other during these virtual meetings, setting the stage for the sale.

An interactive teller machine helps the financial institution as much as it assists the customer. Customers who choose to interact with an ITM agent want to speak with a live human, and they will be listening when the agent makes a suggestion.

Staffing Gets Easier

ITMs often improve staffing and retention efforts. People appreciate remote work opportunities, and they are more likely to remain in remote positions longer. Likewise, the virtual aspect of an ITM position means financial institutions can centrally locate these employees and build a rewarding work atmosphere and culture that could help keep employees happy. When holding on to a good workforce is proving difficult, ITMs contribute to employee retention.

ITM Benefits Make Financial Institutions More Competitive

ITM technology positions our financial institution clients to achieve improved results in terms of customer service and from an administrative standpoint, which means the clients are significantly better off in the long run. ITM technology allows institutions to lean on computers to handle the numbers involved in transactions while seeking and incentivizing staff members who are more adept at connecting with the customer, taking care of the customer’s needs, and getting sales. Why would customers leave for other institutions if your firm has the latest technology and delivers consistent, high-quality service? Why wouldn’t you take advantage of reduced overall expenses and a greater return on investment? ITMs are a powerful solution to move forward in the financial industry.

This May Surprise You, but ITMs Have Been Around for Nearly a Decade

Bank of America began using its first ITMs in 2013, and the technology has slowly but surely moved forward in the time since. An ITM is a powerful piece of technology, and businesses can often be hesitant to adopt new equipment. It makes sense for institutions to take time and analyze information before implementing new technology, but something happened recently that is priming more and more banking customers to take advantage of what ITMs have to offer.

On the COVID-19 Pandemic and ITMs

The situation around the coronavirus made many people less inclined to interact with someone in person when the meeting is not an absolute necessity. Businesses and individuals alike are more accustomed than ever to using technology to communicate in place of physical meetings. This change was challenging for businesses and institutions at the beginning of the pandemic, but people learned to use technology to its advantage and interact remotely. The change brought on by the pandemic makes ITMs even more impactful than they were designed to be. The ability to interact with a teller digitally and complete all the tasks that an in-person transaction would accomplish is important to many people who rely on financial institutions for banking and other purposes. ITMs are a proven solution to the problem of banking for customers who want limited interpersonal activity and need access to a teller.

ITMs Drive Results, But Investment is Important

Implementing ITMs is worth it, but they require effort and a financial commitment get started. Here are some things financial institutions will need to get the greatest benefits from ITM technology:

-The Infrastructure (Hardware and Software)

-Workstations for Remote Agents

-Training and Marketing

-Ongoing Support

Required Backend Infrastructure

Institutions preparing to use ITMs need the hardware and software to make all the components work together. This investment includes endpoint control and audio/visual software, core integration, a multi-user database, and a plug-in for item processing. Putting the right equipment in place is part of modernizing for the future.

Agent Workstations Make It All Happen

Like all employees, your remote tellers will need the equipment required to operate the ITMs and assist customers virtually, whether from a call center, an office, or from home. This means an investment in standard computer equipment that allows telecommunications. Agents will interact with customers in real-time, ultimately leading to a good return on the equipment investment.

Training and Marketing are Invaluable

We want to emphasize the importance of training your employees to provide excellent virtual service. Remember that this technology is about creating a consistently great experience for the customer. Start on the right foot with a team of reliable and experienced professionals who can help you establish a baseline for success.

Another detail of starting with the best foot forward with ITM service is getting the word out about it. We have found that the financial institution’s plans and marketing for an ITM location are the difference-makers in terms of whether the ITM meets expectations. It’s just like kicking off other new products and services in that an initial marketing push is paramount, but the results will be worth the time and effort.

Continued Support is Critical

Much like a new road will need maintenance and care over time, so, too, will an ITM and the team behind it need ongoing support to maintain success. Financial institutions should consider meeting the needs of staff and ensuring the completion of hardware and software updates as part of the investment required to get an ITM up and running. Continued support empowers ITM tellers to help financial institutions reach their goals.

Customers Fully Adopt ITMs After the Second Use

Institutions ask us about user adoption and whether customers prefer using an ITM. We found that customers never go back to using a standard ATM or talking to a teller in person after their second time using an ITM. The experience feels different from what they are used to the first time they interact with an ITM, and it feels more familiar as they begin their second transaction. By the end of that second experience, customers prefer to use ITMs as their primary method of interacting with a financial institution.

The Case Study of a Fully Outsourced Branch

One of our client institutions in Iowa outsourced completely using ITM technology. This branch employs a single ITM unit with no additional FTEs and no call center. A data firm handles the backend infrastructure, and there is no on-site IT team. The branch outsources monitoring and updates. When a customer accesses the ITM, the tellers on-site at other branches receive an alert, and one teller handles the transaction via a prepared workstation. This fully outsourced branch costs the institution less than $50,000 annually, not including real estate costs. This case study proves the concept of small remote branches. We foresee similar setups in grocery stores, hospitals, and even designated locations in small, isolated towns that would otherwise have no convenient access to a branch. ITMs open many possibilities for financial institutions to provide better customer service and meet business objectives.

Is an ITM Worth the Investment?

In most cases, an ITM is a worthy investment due to the flexibility and service improvements it brings to the financial institution and the value of the potential return on the initial investment. The cost avoidance, efficiency, and increased customer service capabilities make an ITM worth it. But each Financial Institution is different, and so are the circumstances involved in determining the ROI for such an expense. The good news is, we can help.

Edge One has worked to develop a comprehensive calculator that can help in determining costs involved, potential returns, and overall ROI. We would be happy to connect if you want to learn more about ITMs, their advantages, and how you might implement them in your budget for the coming year. Submit your contact information and we will be in touch shortly or feel free to call us directly.