What happens when a user makes a transaction via ATM? How do the details of the transaction get back to the banks involved? This blog post offers insight into how ATM processing works. Read on for information about ATM transactions and learn how ATMs connect to networks to make it possible for people to withdraw and deposit cash, check bank balances, and more without visiting the bank directly. This post details how ATM transactions work, what transaction processing entails, what to expect regarding ATM processing costs, a brief word about ATM history, and why Edge One might be the solution for your business’s ATM transaction processing needs.

What is ATM Processing?

ATM processing is the functionality behind transactions at automated teller machines. When someone completes a transaction, such as taking money out of their account, the ATM must be able to connect to the appropriate systems to make sure that person has the authority and funds available to complete the transaction. A series of small steps occur in the blink of an eye to allow this magic to happen. Those steps, collectively, are ATM processing! Keep reading to learn more about these quick but vitally important steps.

How Does ATM Processing Work?

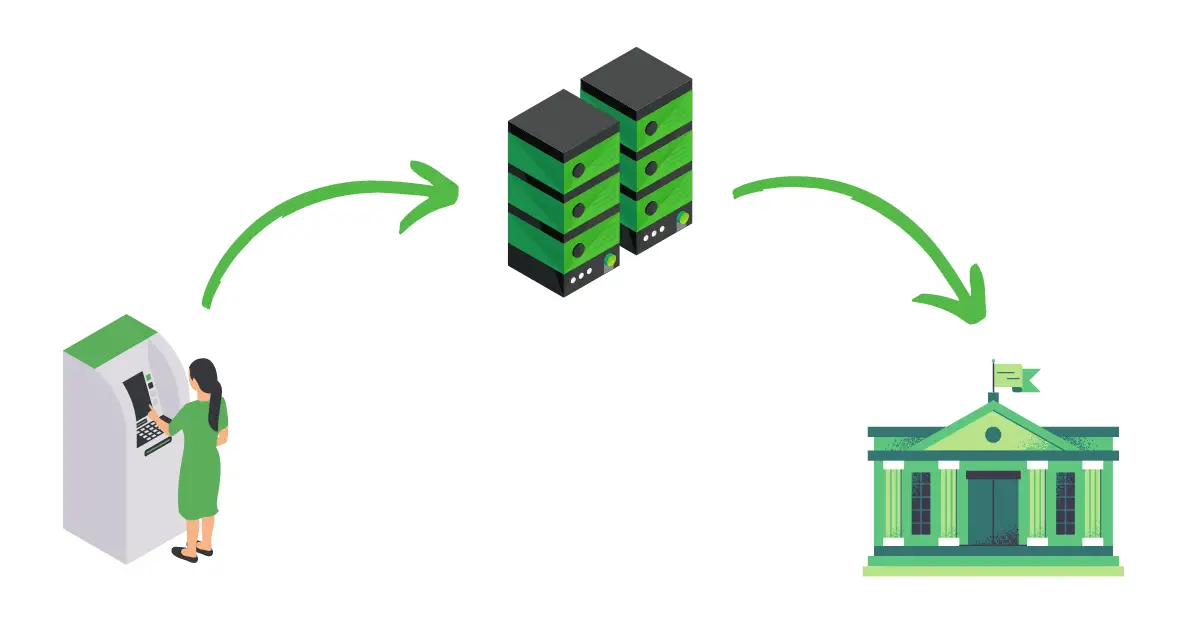

So, how does an ATM get the information it needs to process the transaction? The most basic answer is routers that connect ATMs to the banking systems that either approve or deny the transaction. The ATM receives this approved/not approved status, and its programming responds accordingly, displaying messages to guide the user to complete the request or notify the user that the requested transaction is invalid.

What Happens During an ATM Withdrawal?

Let’s start at the beginning of a withdrawal transaction. We know that when someone wants money from an ATM, they need their ATM card and the Personal Identification Number associated with the card. The person using the ATM first enters the PIN, and the ATM quickly compares the number the user entered with the number on file using massively powerful encryption for both the PIN and the entire packet of information being communicated. The ATM allows the customer to request funds if the entry matches the pin.

When a user requests money from an account via ATM, the machine does not simply spit out the money instantaneously, though the transaction happens quickly. The cardholder’s financial institution must approve the transaction and reimburse the funds supplied to the ATM owner. The ATM processor is the piece of technology that allows this to happen. Since the processor has connections to the networks the ATM supports, it can facilitate the approval and transfer of funds. Once approved, the processor creates a record of the transaction for accurate reporting.

Did You Know?

The cash dispenser on an ATM has a specialized electronic eye that counts each bill as the machine dispenses the cash. The scanner eye is the most accurate method to ensure that the dollar amount subtracted from the account matches the amount released to the ATM user. Technology is amazing!

What Happens During an ATM Deposit?

An ATM deposit transaction begins in much the same way a withdrawal does. Of course, before the user can do anything, the ATM requires the pin number!

Now, let’s consider what happens to move the transaction from the user punching in the pin to the user walking away with the confidence that the ATM is delivering the deposited funds reliably into their account.

During a cash deposit, like during a withdrawal, the ATM connects to the financial institution’s network. It receives the cash, scanning each bill for an accurate count of the deposit amount. Once it has counted the bills, the ATM creates a transaction record of the deposit. Funds from cash deposits are often available immediately.

Most modern ATMs can also accept check deposits. These ATMs scan checks just as they scan cash, but funds may take a couple of days to become available, as the time to fully process a check can vary from one financial institution to another.

Note: some ATMs that accept deposits take them in envelopes only, with the funds to be counted by a teller and manually entered into the account later. These older style machines are quickly being retired and won’t be available much longer.

What Determines How Fast Deposited Funds Become Available?

You may have noticed when making a deposit that sometimes funds become available immediately, and other times it takes a while. So, what’s the difference? The difference is usually a matter of check or cash. When you deposit money, the funds usually become available almost immediately because ATMs can count the cash funds as the bills enter the machine. When you deposit a check, your financial institution has to wait for the payer’s financial institution to make the transfer, which can take some time.

How Much Does ATM Processing Cost?

ATMs rely on data networks and the ACH system to complete the transactions that users request. These networks and the ATM itself require upkeep, and delivering the data to complete transactions requires resources, so ATM processing fees are necessary to meet customer demand. It’s just like when you use a Visa, a Mastercard, or another credit card; the credit card processor requires a small fee to cover the expenses involved in making the transaction happen.

So how much should a business owner expect to pay for ATM transaction processing services? The answer is that pricing varies from one ATM processing company to another, to some extent by geographic region to the next, by the number of transactions a given business completes within the billing cycle, and the complexity of the transactions being supported. Business owners can expect to pay a fee on every transaction, so the total amount spent on ATM processing services each month depends on the number of transactions and the per-transaction rate.

Connect with Edge One to discuss your business’s ATM transaction processing needs, and a team member will provide you with more detailed information about costs: 800-423-3343 (EDGE)

Why Choose Edge One for ATM Transaction Processing?

Edge One prides itself on reliable service, always aiming to deliver the best experience possible for our customers. We know businesses want an ATM processor that is dependable, hassle-free, and responsive to any concerns at rare moments when any issues occur. Our customers are happy to have us for their ATM transaction processing services because they can trust in our award winning professionalism and the reliability.

Here are some details about our ATM processing service that our customers can endorse:

- Simple and Fair Pricing

- Clear Monthly Statements

- Dedicated Customer Service

- Options for Check and ACH Payments

- Efficient Dispute Resolution

- Easy to understand Reporting

- Best in class break fix repair services

- Superior knowledge of the banking system and options available

Did You Know?

Edge One was named the Global Service Provider of the Year by NCR, the world’s largest manufacturer of ATMs, and there were over 550 organizations worldwide competing for this award?

Pricing

We aim to keep pricing simple for at least one significant reason: we want you to know how much you can expect to pay every month. We believe that with straightforward pricing and easy-to-read monthly statements, there is minimal guesswork regarding how much to pay for monthly ATM transaction processing. We ensure that our customers have the information they need to make the most of our service and meet their businesses’ needs.

Did you know?

Edge One has maintained a 99%+ customer retention rate ever since we started measuring it over a decade ago?

Customer Service is King

The Edge One team believes customers who do not receive excellent service from their ATM processor will leave to find another. We strive for excellent experiences for our customers and our customers’ clients.

What About Dispute Settlement?

We minimize customer issues by committing to providing an excellent experience, but the businesses we support can count on us to handle disputes efficiently whenever they arise. Responsive service and customer satisfaction are important to us, so we let our customers know they can contact us about any problems and expect an acceptable resolution.

Paying is Easy with Edge One

We can run quick and easy ACH payments, or you can send payments via check, whichever is most convenient for you and your business. Edge One wants a no-hassle experience for every customer, which means paying should be simple too.

Complete Reporting

We offer reporting beyond the monthly statements to give our customers full details about the ATM transactions and provide them with powerful insights. We know that the more informed our customers are about the transactions and the data, the greater the impact on their businesses. Our reporting allows for invaluable analytics that our customer businesses use to plan and make decisions for the future.

Request More Information About ATM Transaction Processing

Is your business ready to use an ATM for the first time? Are you considering moving to a new ATM processor? Edge One is ready to meet your needs with reliable service and fair rates. If you want to learn more about ATM processing and what we can do for your business, contact us using our contact form and we will reach out to you shortly, or call us directly at 800-423-EDGE (3343). A friendly team member will answer your questions about ATM processing and assist you in becoming part of the Edge One family when you are ready!